US public land policy and applications for the Moon and Marsby Sam Dinkin

|

| There is a possibility that prices for some sites such as the Apollo 11 site could fetch tens or hundreds of millions of dollars if $82 million for a Van Gogh is any indication. |

Lots were sold at auction. Almost all of the acreage went for this minimum price and the average price between 1820-1842 was $1.28/acre or only $0.03 more than the minimum price. This throws into question the value of holding an auction. Auctions were useful for the valuable lots that “in many exceptional instances… brought ten, twenty or even thirty dollars [$350 in current dollars] per acre.” An alternative policy does not put the choicest lots into the hands of the people that value them the most. In an auction, bidders cannot complain that the outcome was unfair because if they wanted to bid more, they could have. This no-sore-losers property of an auction that economists call Pareto Optimality is certainly worth the expense of holding such auctions today.

The auctions were certainly not popular in those days and a strong case can be made that the fairness they achieved was not worth the expense and inconvenience of holding them then. Auctions today, however, are held over the Internet and can be conducted for a couple of bucks on eBay. FCC has sold tens of billions in telecom spectrum by auction for a total cost in the tens of millions. New Jersey has bought $15 billion in electricity for the last three years with a total auction transaction cost in the millions.

With the lower cost of holding an auction today the fairness will be well justified even if the prices are close to the minimum. There is a possibility that prices for some sites such as the Apollo 11 site could fetch tens or hundreds of millions of dollars if $82 million for a Van Gogh is any indication.

Auctions in the 19th century were held in person on the frontier, “where hotel accommodations were inadequate for the occasion”. The Dubuque Daily Republican described a scene reminiscent of waiting in line for rock concert tickets or a widely anticipated movie, “We passed the office about 7 [AM], and saw many who were nearly exhausted from fatigue, having stood upon their feet thirty-six hours.” There is no need for this sort of waste (for land or rock concerts) now that internet auctions can replace in person auctions and lineups.

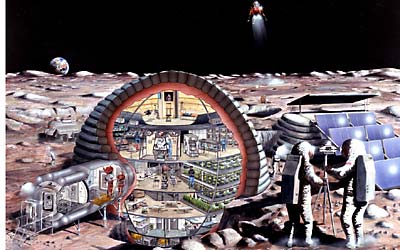

Selling land on the Moon and Mars could be a spur to colonization. By offering would-be colonists clear title to the land they intend to settle, that is one fewer thing for colonists to worry about. Developers could potentially buy up large tracts of land on the Moon or Mars, and then develop transportation services and infrastructure to make colonization viable. This would form a rudimentary industrial policy for helping to develop the Moon and Mars. It would give developers a credible way to profit from their development. Owning a patent gives the developer an incentive to invest in development in a technology because if anyone else develops the same technology, the patent owner can file suit. If the technology is worth billions, the few million spent on a patent lawsuit would be inconsequential and property rights would be well protected. Similarly, owning all land within 100 miles of the south pole of the Moon would give developers a choke hold on all development in that area. By assuring monopoly prices on the post-development real estate, the developer has internalized all the benefits that a development will engender.

Speculators will sometimes be the ones to bid the most. Having a high minimum bid and a low acreage for offer raises the amount of revenue from land sales, but the minimum price or auction price may be too high for people ready to colonize today to afford. This is a policy tradeoff that the US faced and decided they preferred lower prices and more colonists. In the Graduation Act of 1854 and the Homestead Act of 1862, prices were decreased further. In 1857, 1.6M acres were sold at $1.25 [$25 in 2004 dollars] or more and 2.5M acres were sold at about $0.40 [$8 in 2004 dollars] per acre. The Homestead Act of 1862, “provided homesteads of 160 acres free of charge.”

| Owning all land within 100 miles of the south pole of the Moon would give developers a choke hold on all development in that area. |

Even low prices will not necessarily put land into hands of colonists. If there are build-out requirements, then that will make it more expensive for speculators, but the same price for most colonists. I think it is OK for speculators to buy up the land. By setting a market price on the land, they encourage others to develop technologies and services for the frontier. By putting up cash for the land, they are putting their money up as a credible signal that space is open for business. We do not have an urgent need for colonization so there is no compelling reason to reduce revenues from land sales below what speculators would pay for offering the revenue maximizing (small) amount of land.

Right now, there is no legal authority to hold such an auction. The United States should commence international negotiations to amend the 1967 Treaty of Outer Space or withdraw from it to make such auctions possible. While property rights are valuable in and of themselves, the money raised from auctioning the real estate can be used to subsidize space efforts or defray the cost of administering the property rights and surveying the frontier.

Land auctions can efficiently and quickly establish a market price for the value of space colonization. They can create a rudimentary industrial policy that will allow technology developers to capture the gains from their investment in colonization technology. Auctions can place the land in the hands of bidders that value it the most at a low transaction cost. Land auctions can also be used to pursue the goal of getting settlers to the frontier as quickly as possible to help develop and secure it or raise as much revenue as possible. It might not be too long until colonists are singing on Mars, “Oh what a beautiful mornin’!”