Navigating new frontiers: Assessing the opportunity for US entities to launch and return space missions in Australiaby Brett Loubert, Byron Riessen, Arthur Anglin, and Adrian Young

|

| If satellite demand remains strong and the frequency of launches continues to accelerate, so too will the need for increased capacity at spaceports. |

While the awesome footage of rockets thundering into space has quickly become common, it wouldn’t be possible without spaceports. Like airports and seaports serve other modes of transportation, spaceports comprise the necessary infrastructure and operations for space vehicles to access and, in some cases, return from space. Spaceports support a range of important functions such as payload integration, vehicle testing, fueling, communications, and launch.[4]

Looking ahead, plans for new and expanded satellite constellations, particularly in telecommunications and Earth observation, are poised to drive launch demand even higher.[5] The market for in-space servicing, assembly, and manufacturing (ISAM) is also forecasted to grow in the coming decade, which could increase demand for both launch and payload return services. As these in-space activities and services increase, the strain on spaceport infrastructure will likely follow.[6]

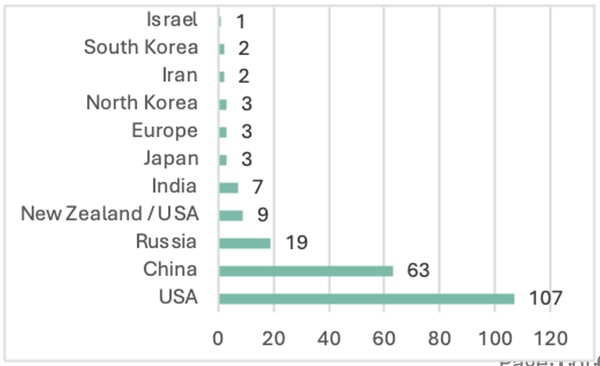

The United States currently leads the world in the number of orbital launches per year, tallying nearly as many as all other countries combined in 2023, as shown in the chart below. This feat was enabled in part by decades of investment from the government and private sector entities to build a robust US launch infrastructure. Spaceports at Cape Canaveral in Florida and Vandenberg Space Force Base in California have been able to support the bulk of launches to date and, as the pace picks up, some launch providers are making use of a growing network of private and public/private facilities all the way from Virginia to Alaska.[7]

Global Orbital Launch Attempts in 2023 by Country. Source: Krebs, Gunter D., “Orbital Launches of 2023”. Gunter’s Space Page. Retrieved August 5, 2024. |

To help keep pace with the upward-trending demand, a new opportunity for US launch providers may be emerging overseas. Australia now hosts several spaceport providers with noteworthy potential in the rapidly evolving landscape of global space exploration and commerce. While still maturing, particularly for orbital missions, these facilities could provide an option for new US-based space companies to build out their launch and return infrastructure or for established operators to expand.

| Even if these dynamics play out and US firms seek capacity at spaceports abroad, the question arises: why Australia? There are several factors unique to Australia that make it an interesting prospect. |

Until recently, the regulatory environment between the US and Australia was complex, particularly with respect to maintaining control of technologies like rockets and spacecraft with national security implications. In July 2024, however, the US-Australia Technology Safeguards Agreement (TSA) was fully ratified, establishing a clearer legal framework for US entities seeking to launch or return space assets in Australia. The TSA aims to streamline the regulatory processes and remove barriers while safeguarding sensitive technology.

The sections that follow explore the opportunity for US companies to operate from Australian spaceports by focusing on three key questions:

Current demand for US rocket launches from Australia appears limited due to entrenched investment in domestic facilities. However, if the launch market continues growing into the 2030s, it may become attractive for US launch companies to establish an international network of spaceports. Some of the potential benefits of international expansion include:

Even if these dynamics play out and US firms seek capacity at spaceports abroad, the question arises: why Australia? There are several factors unique to Australia that make it an interesting prospect. The continent offers access to polar, sun-synchronous, equatorial, and a range of mid-inclination orbits. Its geography, characterized by vast, uninhabited landscapes and less air and sea traffic than Cape Canaveral and Vandenberg, opens a broad window of trajectories for launch, reentry, and landing. Furthermore, Australia is a close US partner and ally, and the TSA now makes it more accessible for US companies to conduct launch and return operations in Australia.

US firms may become well-positioned to capitalize on strategic dynamics that could become increasingly significant over the next decade. Most notable is the alliance between the US and Australia. The countries’ collaboration in intelligence and defense is demonstrated through the Five Eyes alliance and the AUKUS security partnership, respectively.[8] While these agreements lack specific pillars for space launch, they have promising implications for future collaboration in the space domain. For example, the US Space Force’s Commercial Space Strategy emphasizes “diversification” and a “hybrid space architecture,” which could include leveraging international partnerships.[9] While specifics are nascent, allied launch capabilities for defense and intelligence missions could provide a strategic benefit to both countries’ defense capabilities as well as the commercial space industry that supports their missions.

US launch companies may be unlikely to use spaceports abroad as primary launch sites for payloads manufactured in the US – the cost and complexity of logistics would likely outweigh most benefits. However, the business case changes for payloads originating elsewhere. For example, customers with satellites built in the Asia-Pacific region (including Australia) might streamline logistics and minimize costs when launching or returning in Australia versus the US. Further, Japanese satellite operators may benefit from more permissive and less costly regulatory environment compared to domestic launches. In any case, US operators would likely need a clear and consistent signal of regional demand to justify expansion for commercial customers.

Australia presents several distinct advantages as a destination for payload return, particularly when compared to established space-faring regions like the US and Europe. Australia’s sparsely populated landscape enables safer land-based returns, plausibly reducing both risk and cost. Less crowded airspace also makes for simpler clearance. Adding Australia as a payload return destination for US space firms may also increase agility or enable a higher overall cadence for return missions because overflights are out of phase compared to the US. These factors could be valuable over the next decade if commercial space stations come online as planned. For example, in-space manufacturing of pharmaceuticals is a commonly cited application for future space stations and would require reliable and efficient transport to ground-based logistics networks.[10]

The US-Australia TSA mandates strict controls over the handling of sensitive items including products, equipment, tools, software, and technology that is classified as military or dual-use in the USA and Australia. While the TSA presents a positive move toward both countries approving space launch activities, companies will still need to obtain the appropriate export authorizations from both countries. Companies also need to implement adequate controls to comply with export regulations. Below are some of the basic considerations for companies:

Streamlining the systems and processes used to meet TSA requirements—and ensuring compatibility between related Australian and US regulatory frameworks—may reduce administrative cost and risk. Doing so may be a promising strategy for Australian spaceports to attract business from US launch providers.

It is plausible that with continued growth in the space industry, particularly in scenarios with a strong global customer base for commercial launch services and increased US-Australia collaboration in defense and intelligence space missions, US firms could seek to expand launch and return operations to Australian spaceports. Of course, preparing the Australian spaceport market will likely take time and investment.

At a minimum, this involves the continued development of essential spaceport infrastructure to support launch and return operations. However, making Australia an attractive destination for US firms may entail further steps to strengthen the overall space industry with support from the Australian government and the entire commercial space enterprise.

For Australian spaceports to be a viable destination, they need adequate facilities. The infrastructure requirements for launch and return missions are unique, a factor that may influence the strategic choices and timing for development as spaceport operators court prospective customers.

| Having the infrastructure to operate is, of course, a necessity. But “if you build it, they will come” is an unlikely strategy for success. |

Launch infrastructure, particularly for orbital flights, is extremely costly. It starts with reliable access to essential resources like water, common propellants, telecommunications, ground support equipment, safety systems, and a transporter/erector. These can often be used to support multiple customers. However, elements closer to the vehicle often cannot. Many launch providers seem to favor bespoke components for much of the launch complex, due to the added flexibility and control they offer over multi-use pads. The resulting cost to build a dedicated launch site can range from tens of millions of US dollars for a small-lift vehicle to one billion dollars or more for heavy-lift vehicles. Co-investment strategies between government entities and commercial players across the value chain—including the spaceport, the launch and/or return operator(s), and possibly downstream customers—may be needed to fulfil these substantial capital needs.

Supporting return missions may be less capital-intensive, but still requires a few key infrastructure components. Nearby payload processing facilities are needed, and they may have unique security, environmental, and scientific requirements. In addition to clean rooms and laboratories, these facilities may also need to support rapid packaging, shipping, and integration with international transportation networks.

Having the infrastructure to operate is, of course, a necessity. But “if you build it, they will come” is an unlikely strategy for success. A host of supporting capabilities and conditions will also need to be in place across the broader space industry ecosystem for Australia’s spaceports to be a viable business proposition for US firms.

A strong demand signal for payloads (to launch or return) is of utmost importance. Without it, potential investors—whether launch companies or otherwise—may see too much risk to commit the funding needed to expand operations or build new facilities. To be successful, Australian spaceports will need to prove out the presence of sustainable demand. And, for the cost structure to warrant operations in Australia, domestic and regional payloads (including Australian government payloads) will likely need to be part of the mix.

Another component of a strong space industry ecosystem is local engineering talent and manufacturing capability. The ability to build, operate, and maintain space vehicles and their associated components is not only indicative of a well-rounded ecosystem but also a key part of a competitive cost structure. For example, a launch provider with a reusable upper stage would be unlikely to find economies of scale if refurbishment and reuse involved shipping hardware elsewhere in the world.

| To capture the opportunity, Australia’s spaceports would likely need to meet several conditions that are missing today. |

Finally, sustained policy and funding support from the Australian governmental is seen as a key ingredient for the country’s space industry. Unfortunately, recent budget cuts could undermine the creation of sovereign space capabilities[11] and make it harder for the Australian space industry to secure funding.[12] As a result, some US launch providers may approach opportunities in Australia more cautiously.

Over the past five years, global orbital launches have doubled, primarily driven by the increased deployment of medium and small lift vehicles, with the US leading in launch numbers. Whether it's satellite communication, in-space or on-orbit Servicing, Assembly and Manufacturing (ISAM/OSAM), Earth Observation, or exploration missions, the need for in-space capabilities continues to increase.[13] Amidst this growth, Australian spaceports have a significant opportunity to support the necessary facilities and services for launch and return activities.

To capture the opportunity, however, Australia’s spaceports would likely need to meet several conditions that are missing today. Developing new infrastructure, broadening capabilities across the Australian space industry ecosystem, and building systems to comply with the TSA and other regulations are critical steps in the journey. Recognizing these needs, stakeholders and key space service providers may need to navigate significant uncertainties to capitalize on the industry's long-term potential. But by understanding the key drivers and challenges shaping prospects for US-Australia collaboration in launch and landing on in Australia, stakeholders can position themselves to harness the opportunities presented by this rapidly evolving landscape.

This article contains general information only and Deloitte is not, by means of this article, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This article is not a substitute for such professional advice or services, nor should it be used as the basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional adviser. Deloitte shall not be responsible for any loss sustained by any person who relies on this article. As used in this article, “Deloitte” means Deloitte Consulting LLP, a subsidiary of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure.

Note: we are now moderating comments. There will be a delay in posting comments and no guarantee that all submitted comments will be posted.